Until recently, Uber drivers had to own their own vehicles (10 years old or newer) and pay all their vehicle-related expenses out of their earnings. Yet as Uber has grown, the vehicle requirement has proven to be a major barrier to growing the number of drivers on the platform — at least partly because drivers have an incredibly high turnover rate, a testament to the fact that driving for Uber is generally not very stable or lucrative work. Recently, the company has found a solution: facilitating car loans directly for drivers so they can rent a car from Uber in order to drive for Uber — in effect, paying back the company as it pays them.

Uber’s Subprime Auto Loans

The largest US ride-sharing platform, Uber has been infused with billions of dollars in investment and, as a result, is in rapid growth mode, relentlessly hiring drivers around the country. Getting a driver’s license is a relatively easily learned skill in the United States — hence, finding drivers is not necessarily a problem for Uber; rather, finding drivers who own cars that meet Uber’s vehicle requirement is. Thus, over the past few years, Uber has made a number of deals to experiment with offering vehicle leases to drivers before finally launching its own auto-loan company, Xchange Leasing, in 2015 to offer subprime loans to drivers. “Subprime,” in finance speak, refers to the credit status of the lessee: “prime” borrowers are desirable ones with a high probability of paying back loans on time, whereas “subprime” borrowers are less than optimal for banks — and hence usually suffer higher premiums, interest rates and more predatory contracts to make up for their undesirability as clients.

Those with good credit can usually get their own vehicles, so Uber targets those with poor credit — economically disenfranchised workers who may feel like Uber is their only option for a job and who thus become deeply indebted to Uber merely in order to work.

A May 2016 report by Bloomberg uncovered how Goldman Sachs gave Uber a $1 billion loan to finance subprime auto loans through Xchange — and the most hated bank in America doesn’t just hand out that much money without the promise of healthy returns. Uber has stated that its goal is to put more than 100,000 Uber drivers on the road through its auto-financing programs. “That requires dipping into the vast pool of people with bad or no credit,” wrote financial reporters Eric Newcomer and Olivia Zaleski.

On its face, Xchange seem like a good deal. Drivers pay a $250 deposit, followed by weekly payments for the three-year term of the lease. Basic maintenance is covered, and there’s no limit on mileage, so there’s no disadvantage to putting in longer hours. The cars can even be returned after the first 30 days without any cancellation fees, but drivers who return the cars within 30 days must forfeit the deposit.

Auto-finance experts who spoke to Bloomberg called Xchange’s subprime loans predatory and — counter to Uber’s claims — “very much driven toward profiting off drivers.” Those with good credit can usually get their own vehicles, so Uber targets those with poor credit — economically disenfranchised workers who may feel like Uber is their only option for a job and who thus become deeply indebted to Uber merely in order to work.

Since the collective value of the subprime-auto-loans market recently surpassed $1 trillion, financial experts warned of a crash. While a bursting auto-loans bubble wouldn’t be as disastrous as the 2008 financial crisis — since auto loans are worth considerably less than mortgages — a $1 trillion loan market is significant in an economy that continues to struggle with low growth rates.

There is ample evidence for the abusive and predatory nature of subprime auto loans, both from Uber and others. A Last Week Tonight segment detailed how ads for subprime auto loans are targeted at people who have already declared bankruptcy, and an LA Times investigation followed a single car that had changed hands eight times in just three years through a cycle of resale and repossession. Uber recently had to pay $20 million to settle claims that it had misled drivers about how much they could earn and about the quality of its financing options.

Yet the social discord stemming from Xchange’s subprime leases is compounded in a gig-economy business model like Uber’s. Here the realities of contract labor contradict the steady income required to pay off an auto loan. Rather, these loans entrap gig-economy workers into becoming dependent on oft-unstable work and pay.

A Cycle of Exploitation

When drivers sign up for a vehicle through Xchange, it becomes much harder for them to leave Uber. That means that if the company changes its terms in a way that penalizes drivers (or lowers their wages) in order to increase profits — which it has a record of doing — they’re stuck. These Uber drivers, who are not employees and have no means of collective-bargaining, are then forced to pay inflated car payments for years.

Hubert Horan argues that Uber is incentivized to cut driver pay because it cannot achieve better margins with scale. In a series for Naked Capitalism, he details how the cost of a ride is significantly subsidized by venture-capital funding and explains that 85 percent of car-service costs come from drivers, vehicles and fuel. Whereas a shipping company like Amazon can reduce costs with scale, the only way Uber could ultimately improve its margins is by cutting driver compensation.

In its investigation, Bloomberg spoke to an Uber driver named Shawn Hofstede, who leased a 2016 Toyota Corolla through Xchange for $155 a week after getting in a car accident. Just two months later, Uber slashed its fares. While Uber argues that rate cuts drive up demand for rides, meaning that drivers get more rides to offset lower fares, that doesn’t seem to be how it works in the real world. Hofstede’s weekend earnings dropped from $200 to $140, and he ended up driving just to meet the payments. Eventually, he got fed up with this arrangement and told Xchange to pick up the car. He stopped paying and stopped driving for Uber.

The average wage for an Uber driver in Boston is $20 an hour — meaning drivers renting a $12/hour Zipcar to finance their Uber driving may make less than Boston’s $11/hour minimum wage.

The subprime nature of these leases forces people to pay a lot more than the actual value of the vehicles they receive through Xchange. The driver referred to Bloomberg by Uber as a success story was paying $160 a week for a 2015 Honda Civic, which would come to $25,210 after three years; she would need to pay another $5,000 if she wanted to keep it after the lease was over. However, the Kelly Blue Book value of the Civic was far less: $18,142, as opposed to the $30,210 she would pay assuming she makes payments on time. Given that full-time drivers report making between $30,000 and $45,000 after expenses, this means Uber is taking about a third of the salary of its drivers who sign up for the program and work full-time for three years.

Beyond Xchange, Uber now offers another “vehicle solution” that seems to be an even worse deal for workers. A program being trialed in Boston allows drivers to rent a vehicle from Zipcar for $12 an hour. This sounds like a decent deal on the surface, yet since the average wage for an Uber driver in Boston is $20 an hour, drivers might potentially make less than the state’s $11 minimum wage — and that’s before the many additional fees Zipcar sometimes charges.

The vehicle-financing options offered by Uber turn an exploitative relationship into an abusive one. Drivers are already forced to pay for their own vehicles and the other costs that come with them while contending with precariously low earnings (especially after those vehicle costs are taken into consideration) and a lack of rights and benefits.

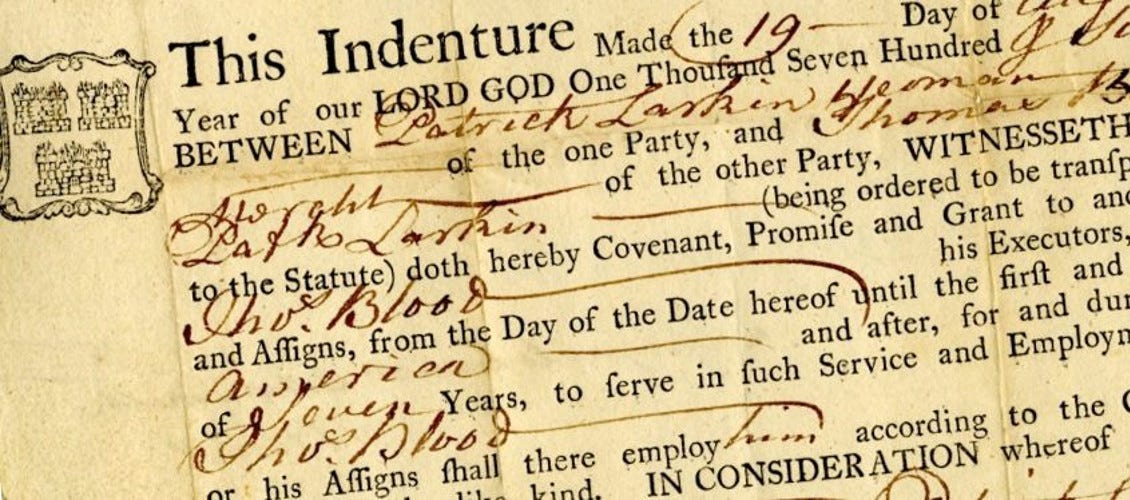

Drivers become trapped in this uneven relationship when they take a subprime Xchange auto lease. Uber automatically deducts their inflated auto-loan payments from driver earnings, and drivers have no recourse when the company slashes fares. This scenario is not dissimilar from indentured servitude, whereby workers are forced to work to pay off a debt on the master’s property that enables them to work in the first place.

Uber’s marketing department is among the best in Silicon Valley. It shamelessly spins exploitation as freedom and pay cuts as opportunity. Xchange’s leases have been given the same treatment, but there should be no doubt that they are just another means for Uber to benefit at the expense of the drivers who use its platform.